SIP - Your way to Wealth

CHASE YOUR FIRST ₹1Cr SIPBOOK DREAM

SIP Planning: The Smart Way to Build Wealth & Plan Retirement

Unlock the power of systematic investing to achieve your financial goals and secure a peaceful retirement.

🚀 Ready to Grow Your SIP Book?

Connect with our Relationship Manager to strategize your growth.

Wealth Creation vs. Early Retirement via SIP

Explore two powerful paths to financial freedom with SIPs.

Presenting SIPaarambh

A Program to Support Your SIP Growth!

How it works?

| SIP Book Growth | SIP Kits |

|---|---|

| Add ₹1 Lakh | SIP Starter |

| Add ₹5 Lakhs | SIP Achiever |

| Add ₹10 Lakhs | SIP Magnet |

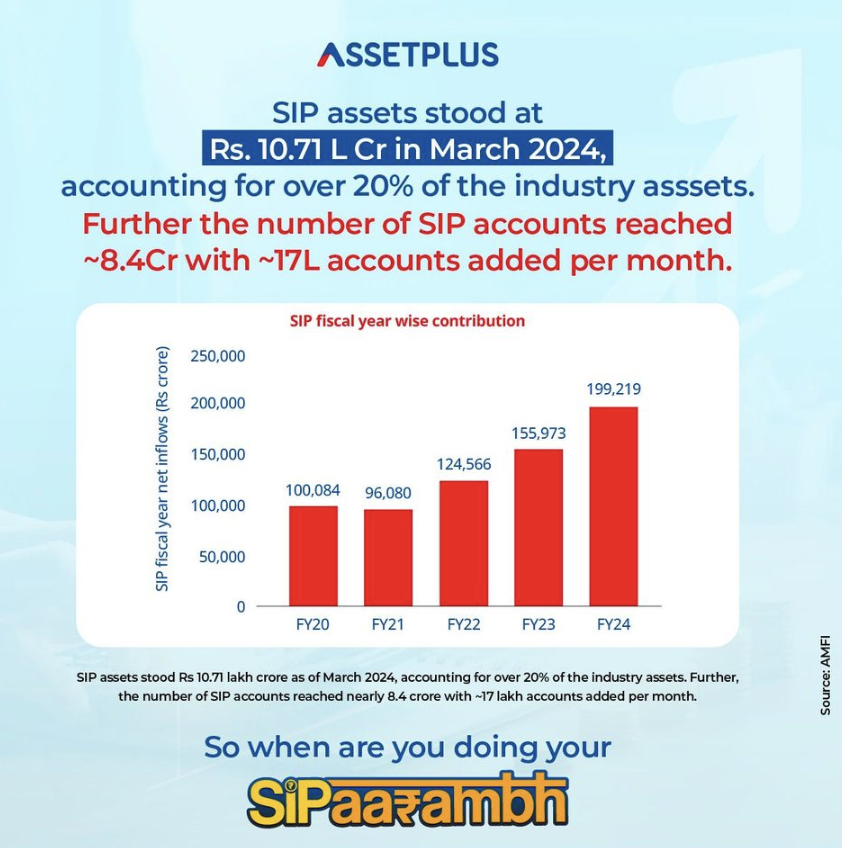

Why SIP is the Foundation of Wealth Creation

SIP (Systematic Investment Plan) is more than just an investment; it's a powerful habit that builds lasting wealth.

SIP for Wealth Creation

See how consistent SIP investments can lead to substantial wealth over time.

| SIP Amount | Investment Tenure | Expected Return (12%) | Wealth Created |

|---|---|---|---|

| ₹5,000 | 20 Years | 12% CAGR | ₹50+ Lakhs |

| ₹10,000 | 25 Years | 12% CAGR | ₹1.7 Crores |

| ₹20,000 | 30 Years | 12% CAGR | ₹6.5 Crores |

Message: Start early, even with small amounts – it's not about how much you invest, it's about how long you stay invested.

The above calculations are for illustrative purposes only. Mutual Funds are subject to market risks. Read all related scheme documents carefully.

Retirement planning without SIP top up

Plan your retirement effectively without relying on annual SIP top-ups.

Assumptions: SIP CAGR @12%

| Goal Corpus at Retirement | Years to Retire | Monthly SIP Needed | Total Investment | Wealth Created @12% CAGR |

|---|---|---|---|---|

| ₹1 Crore | 30 Years | ₹2,000 | ₹7.2 Lakhs | ₹1 Crore |

| ₹2 Crores | 25 Years | ₹8,000 | ₹24 Lakhs | ₹2 Crores |

| ₹3 Crores | 20 Years | ₹20,000 | ₹48 Lakhs | ₹3 Crores |

| ₹5 Crores | 15 Years | ₹55,000 | ₹99 Lakhs | ₹5 Crores |

| ₹10 Crores | 10 Years | ₹1.45 Lakhs | ₹1.74 Crores | ₹10 Crores |

The above calculations are for illustrative purposes only. Mutual Funds are subject to market risks. Read all related scheme documents carefully.

Retirement Planning via SIP with Annual Top-Up

Supercharge your retirement corpus by incorporating annual SIP top-ups.

Assumptions: SIP CAGR @12%, Annual SIP increase (Top-Up) @10%

| Goal Corpus | Years to Retire | Starting SIP | Annual Top-Up | Wealth Created @12% CAGR |

|---|---|---|---|---|

| ₹1 Crore | 25 Years | ₹1,800 | 10% | ₹1 Crore |

| ₹2 Crores | 25 Years | ₹3,500 | 10% | ₹2 Crores |

| ₹3 Crores | 25 Years | ₹5,200 | 10% | ₹3 Crores |

| ₹5 Crores | 25 Years | ₹8,600 | 10% | ₹5 Crores |

| ₹10 Crores | 30 Years | ₹10,000 | 10% | ₹10 Crores |

The above calculations are for illustrative purposes only. Mutual Funds are subject to market risks. Read all related scheme documents carefully.

Your Future, Powered by SIPs

- 🌱 Start your SIP with Passion

- ⏳ Continue with Patience

- 📈 Scale it with Persistence

SIPaarambh Kits

Add one more Lakh to your SIP book and unlock exclusive goodies! The more you add, the bigger the rewards!

Achieve your first milestone and unlock these exclusive rewards!

Click below to see the goodies!

*Conditions apply. Images shown are for illustrative purposes only; actual products may vary.

Elevate your SIP book and gain access to enhanced benefits!

Click below to see the goodies!

*Conditions apply. Images shown are for illustrative purposes only; actual products may vary.

Reach the pinnacle of success and claim your ultimate rewards!

Click below to see the goodies!

*Conditions apply. Images shown are for illustrative purposes only; actual products may vary.

SIP Awareness & Knowledge Sharing

Empower your clients with essential SIP knowledge through these insightful resources.

Stay Ahead of Inflation with SIPs

SIPs - Your Long Term Partner for Wealth

Find the Right SIP for You

Stay Invested and Stay Ahead with SIPs During Market Crises

SIP for Every Stage of Life

Daily SIP - The Dynamic Version of Traditional SIP

Supercharge Your SIP Business

Marketing Arsenal

Access your partner dashboard for specially designed marketing collaterals that will skyrocket your business growth!

Use Posters Now 🚀Transform Your Business

Get personalized marketing materials at exclusive partner prices!

SIPaarambh Rules & Conditions

Campaign Period

SIPaarambh 2025: 1st Aug - 30th Sept

Only Net SIP Book will be considered for this program.

Long Term Schemes Eligible – Equity and Hybrid (excluding Arbitrage).

Items will be dispatched within 30 days of reaching the milestone.

On achieving two or more milestones, additional Business Development material will be provided.

Please ensure compliance with scheme suitability and the AMFI Code of Conduct when recommending schemes.

This offer is valid only for ARN holders registered with AssetPlus.

AssetPlus reserves the right to cancel or recover costs in case of unethical practices.

Management's decision will be final and binding.